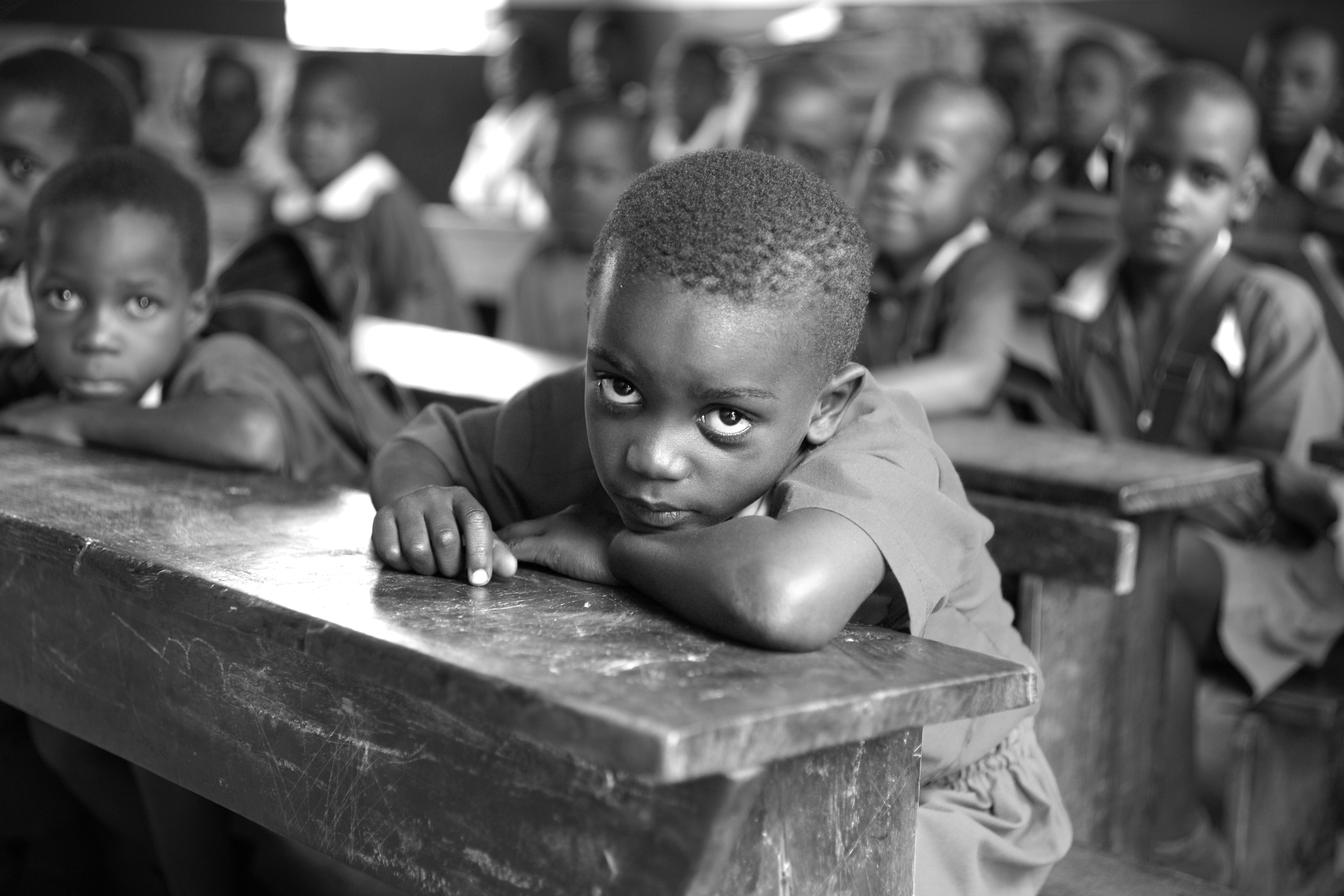

About Our Foundation

A legacy of compassion and community impact

The Kapani Family Charitable Foundation is a private foundation established to support transformative charitable initiatives that empower communities and create lasting positive change. Based in Naples, Florida, our foundation is committed to making strategic investments in organizations and programs that address critical community needs.

As a tax-exempt organization recognized by the IRS, we uphold the highest standards of transparency, accountability, and excellence in our philanthropic endeavors. Our foundation focuses on supporting initiatives in education, healthcare, social services, and community development throughout Florida and beyond.

Compassionate

Driven by empathy and care

Transparent

Accountable to our community

Innovative

Forward-thinking solutions

Foundation Information

Organization Type

Private Foundation

Location

3600 Nelsons Walk, Naples, FL 34102-7869, USA

EIN

47-2298390

IRS Status

Tax-Exempt Organization